Prepaid Debit Card Benefits

Wisely member benefits help you

get more for your money

Get early direct deposit to

better manage your money

With early direct deposit, you can get paid up to 2 days early. Get early pay from multiple jobs, government benefits, and tax refunds, too. Best yet? Take your Wisely prepaid debit card with you, even if you change jobs.

Avoid hidden fees and minimums

With Wisely there are no minimum balance fees or fees on everyday spending. No annual fees, overdraft fees, or fees for in-network ATMs either. When there are certain types of fees associated with your card, you can count on us to be transparent about it.

Protect yourself against debit card fraud

Certain transactions are protected by either the Visa® or Mastercard® Zero Liability Policy. Real-time alerts and ability to lock your card offer more control. Certain cards come with EMV chip technology for added protection.

Earn rewards for all the ways you like to shop

Use your Wisely card wherever Visa debit card or Debit Mastercard is accepted. Add your card to your digital wallet for contact-less payments. Plus, earn promotions at thousands of participating retailers when you buy eGift cards through myWisely. Add your card to your digital wallet for contact-less payments.

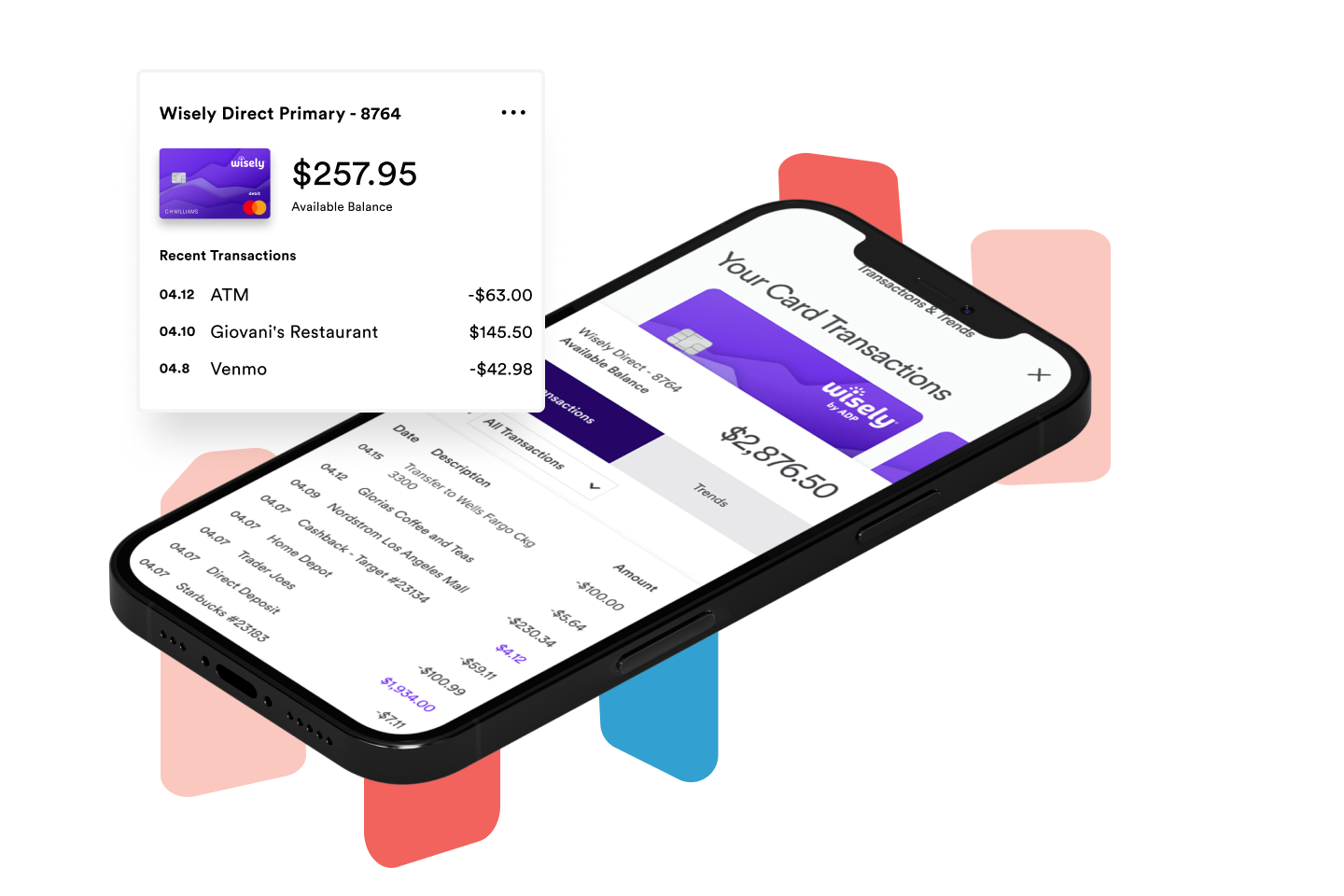

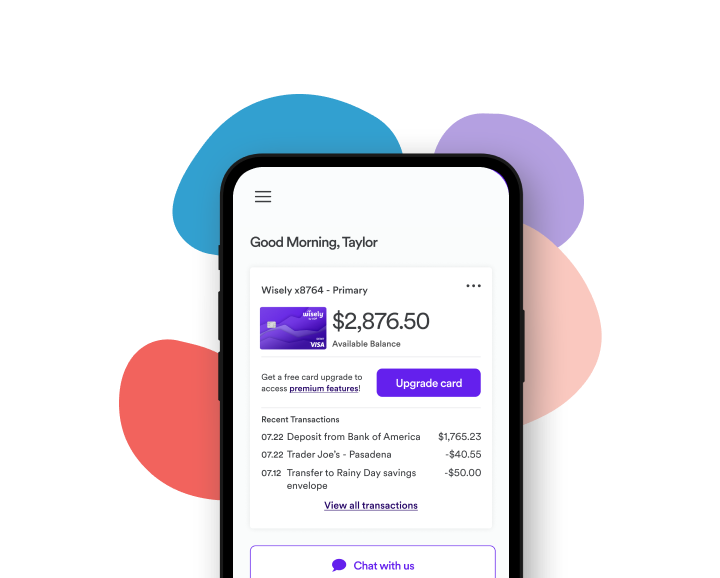

Meet your budgeting and savings goals

Schedule payments and pay your bills securely with online bill payment. View and track payment history all in one place. Save with our savings envelope that lets you automatically set aside money into categories.

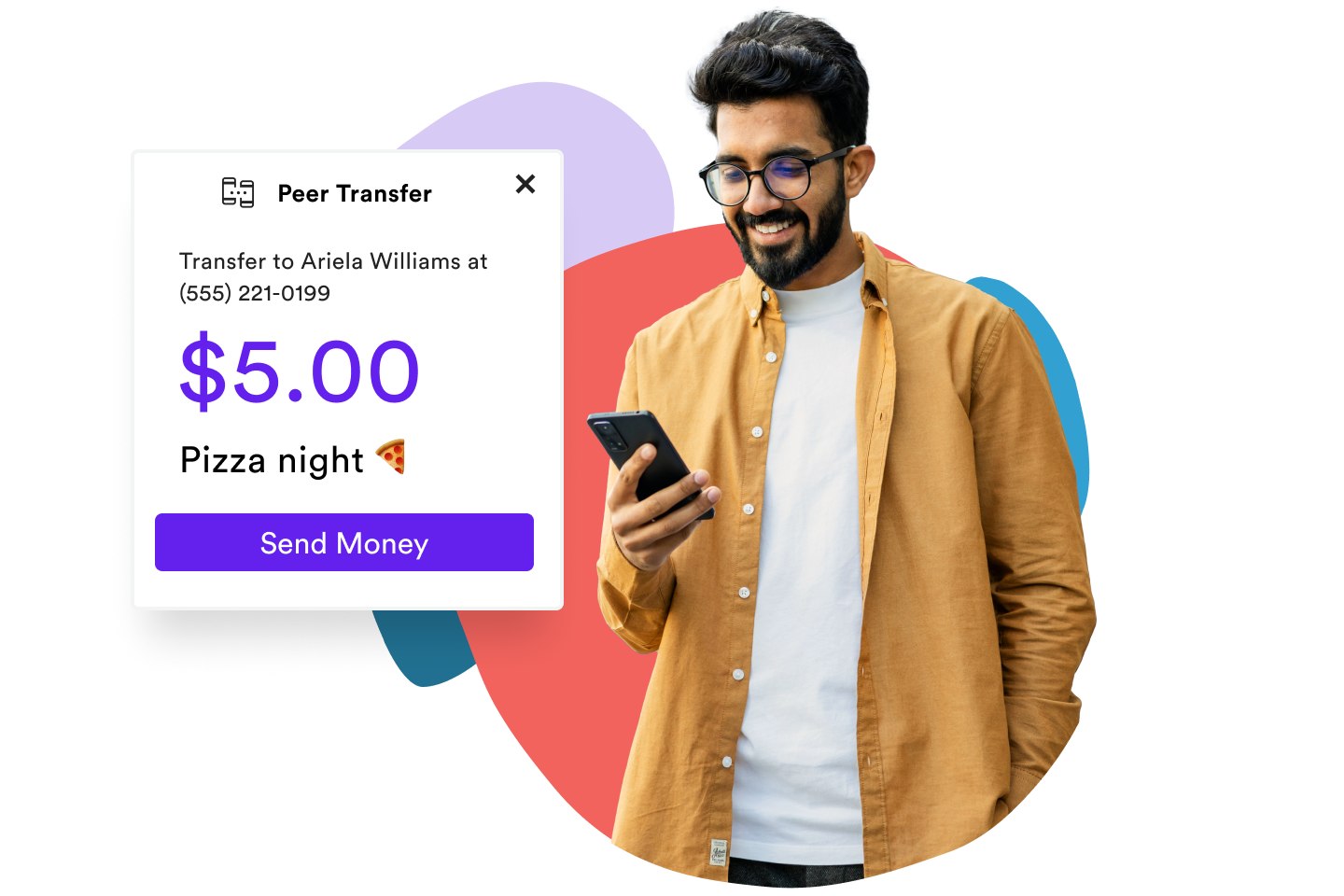

Move money when and where you need it

Get cash at thousands of surcharge-free, in-network ATMs nationwide. Send and receive funds from Venmo and PayPal, plus transfer money from your Wisely account to external accounts. You can even transfer funds to other Wisely cardholders who are enrolled in peer transfer – almost immediately at no cost. ID verification may be required for certain features.

Get the most out of Wisely by verifying your ID

If you’re currently using your Wisely prepaid debit card to receive direct deposit from your employer, make sure to verify your ID to access the following benefits.

- Get full access to Wisely card features.

- Add funds to your card at 90,000+ retailers.

- Take your card to your next job, too.

- It won’t cost you a thing.

To activate your Wisely card

- Log into the myWisely® app or mywisely.com.

- Click or tap on Activate Card and follow the instructions.

Wisely Pay members: 1-866-313-6901

Wisely Direct members: 1-866-313-9029

Wisely Cash members: 1-877-431-5860

- Log into the biller/retailer website.

- Enter your Wisely card information in the recurring bill payments form.

The bill pay services available within the myWisely® app do not manage recurring payments.

- Check your balance

- View transaction history

- Find nearby ATMs

- See spending trends, and more

If your card is lost, stolen, or misplaced

Be sure to instantly lock your card using the myWisely® app or on mywisely.com so your card cannot be used.To lock your card

- Log into the myWisely® app or mywisely.com.

- Go to Account Settings, then open Card Settings to lock your card.

If you find your card, you can instantly unlock it and resume using it.

If you cannot find your card, call Wisely Customer Service immediately:

Wisely Pay members: 1-866-313-6901

Wisely Direct members: 1-866-313-9029

Wisely Cash members: 1-877-431-5860

How do I know which card I have?

We will cancel your card and transfer the funds to a new card that will be sent to you. Please note that funds are not transferred until your new card has been activated.