Top three signs you should consider the 50/30/20 rule.

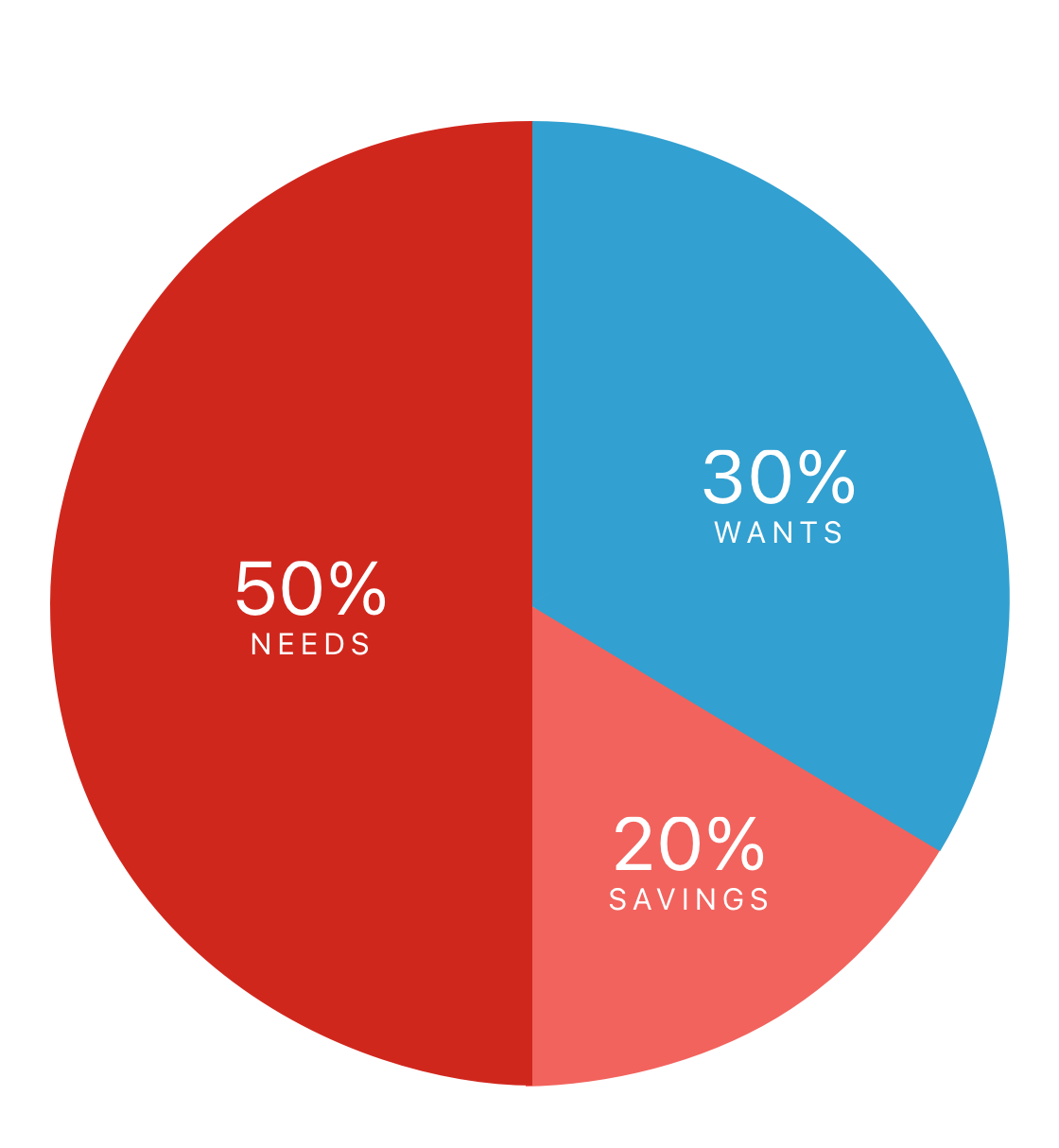

What’s the 50/30/20 rule? It’s a simple way to find your way to financial wellness: 50% of your budget on needs, 30% on wants, 20% on savings.1

Rent, utilities, and groceries run the show.

We all need food and shelter — but we also need leisure time. There’s no shame in clipping coupons or negotiating rates to keep the bare necessities within 50% of your budget or less.

50% needs

You're skipping those Friday nights out.

Sometimes things can get tight when payday’s still a week out. But if missing out on R&R time is becoming a pattern, you might benefit from 50/30/20. Try to focus 30% of your pay toward wants — like a vacation. You deserve it.

30% wants

Retirement? What’s that?

There’s more to life than rent and bills. So don’t cheat your future. You’d be surprised how quickly 20% of each paycheck can add up toward savings goals like a new home —or a comfortable retirement.

20% savings

Think you could use a little 50/30/20 love?

You can start today with as little as $10 per paycheck.