Mastering responsible spending is a fundamental skill in personal finance. Responsible spending isn’t defined as any one thing but is made up of a variety of habits that often include sticking to a basic budget, building an emergency fund, and managing debt in order to create a more stable financial future.

What does it mean to be financially responsible?

We define financial responsibility as living within your means. This means establishing a habit of spending less than you earn. By continually spending less, you may be better-positioned to set aside savings, pay your bills on time, and even have money left over for yourself.

To truly understand the meaning of being financially responsible, you have to consider numerous factors. These steady practices may help you get there.

Living within your means

While there are numerous ways to be responsible with money, living within your means is the primary principle. Adopting a mindset around money that involves setting aside savings while minimizing spending may help you have a stronger financial future.

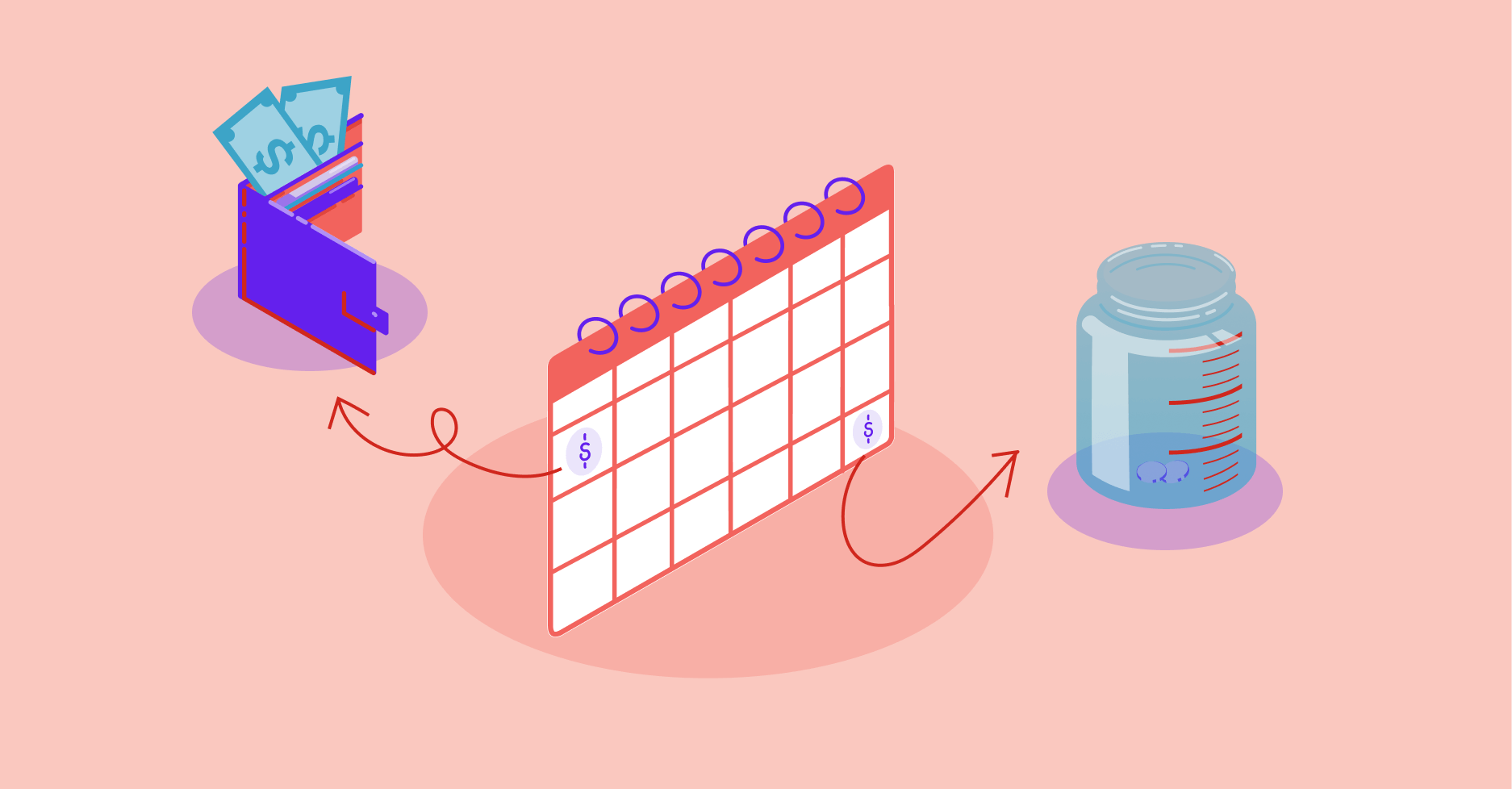

On the other hand, if you spend all of your paycheck every month–without saving, without budgeting–it might be time for an honest look at where your money is going. Living within your means involves an ongoing practice of spending less than you make. If this seems impossible or daunting at the moment, you can always start small by setting aside a small amount of savings out of each paycheck. This is called paying yourself first. When you pay yourself first, you’re establishing a healthy financial pattern.

Paying bills on time

In thinking about how to be more financially responsible, looking at your bill payment history can give you lots of insight.

Do you set aside money at the beginning of the month or out of each paycheck to cover your bills? Setting aside money just for bill payment can make it easier to budget. Things like rent, phone bill, and household utilities have to be paid every month and the amounts are generally the same each time. When you deduct the amount you need for bills, that money is basically being set aside, not to be touched for anything but bills.

Prioritizing financial obligations like bill payments is a critical aspect of financial responsibility. So is paying bills on time, which may help you avoid late fees (save money) and could even help you build credit.

Get Ahead of Paying Your Bills

Pay bills online with Wisely. Schedule payments in advance so you never miss a due date.

Being financially responsible means being smart when making financial decisions, large and small.

Building a budget: The first step to responsible spending

It may seem obvious but if you can’t see where your money is going, you can’t very well manage it. That’s why creating a basic budget is so critical. Keep in mind, a budget doesn’t have to be complicated. It can be written on a piece of paper or organized in an online spreadsheet – whatever works for you. But it must be used and updated regularly. This kind of discipline is a core component of financial responsibility and helps you establish good spending habits.

Here are some of the benefits of budgeting:

- Get clear on your monthly income and expenses

- See the big picture, such as how much you need for paying bills each month

- Discover how much is really left over, so you can avoid overspending

Seeing all of your income and expenses listed out is a reality check for many, especially if you’re used to budgeting in your head. When you look at your written budget, you may be reminded of expenses you’ve forgotten you had. You may also be more mindful of the little expenses that add up quickly in the course of a month.

Budgeting strategies: Wants vs. needs

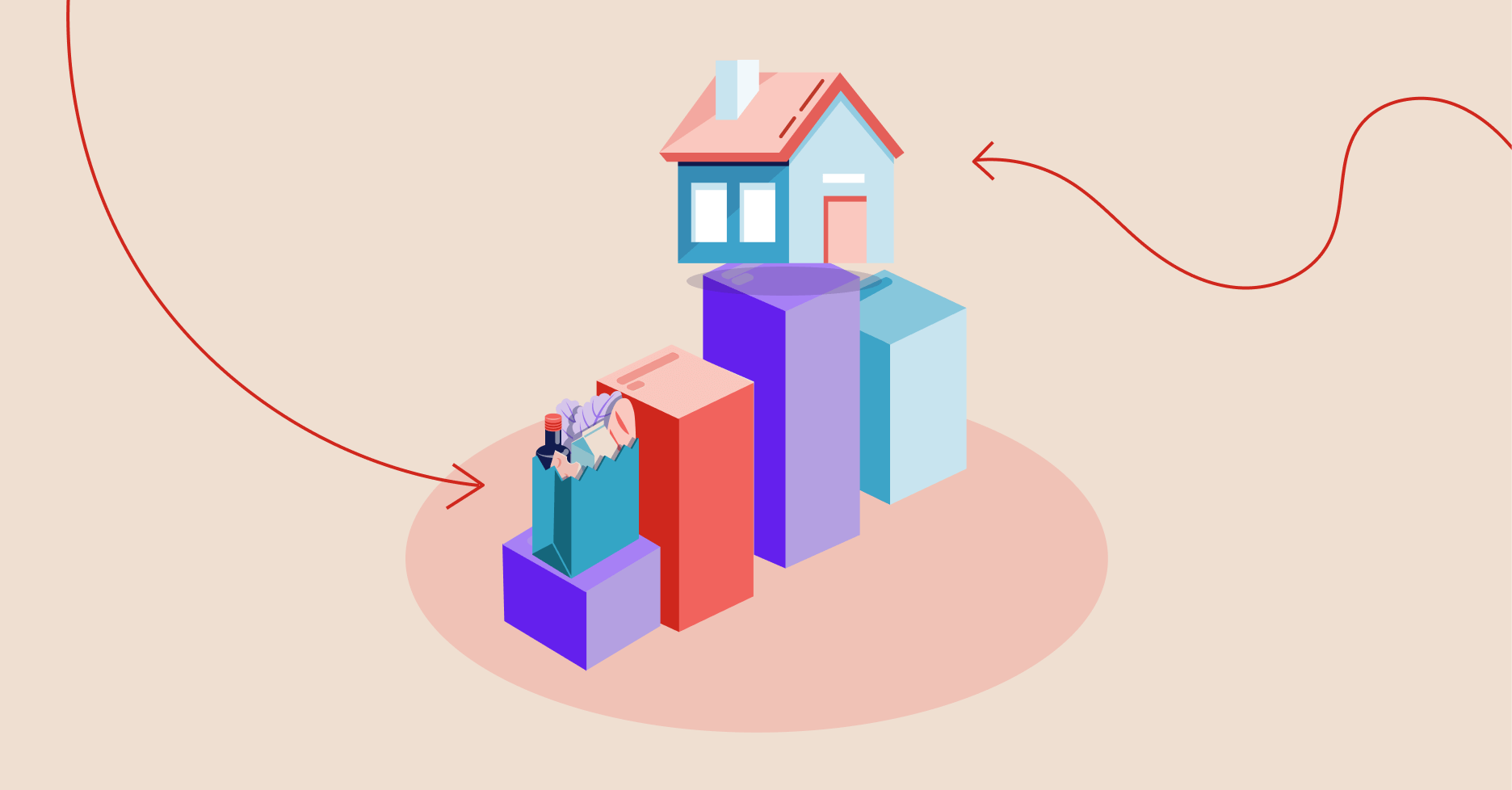

Another useful task is to do the “wants vs. needs” exercise. This involves looking over your last month or two of transactions.

As you go through each transaction, put an N for Needs next to everything that was truly a “need.” A need is anything critical to daily or monthly living, like rent payments, transportation, utilities and phone bills. Then go through and put a W for Wants next to everything that was a “want.” These are things you just wanted to have, couldn’t wait to have, or unexpectedly decided to spend money on.

You may also find this exercise to be eye-opening. If you’re honest with yourself, you may notice many of those “wants” you could probably live without.

Assessing income and expenses

To determine your monthly budget:

- First, list exact amounts of income from all sources, such as a second job, child support, and government benefits or assistance.

- Then gather up all of your bills, like phone, electric, rent and so on. List out the monthly expense for each. If you have a bill that fluctuates (for example, your electric bill may be larger in the summer because you run the air conditioner), you can determine your average monthly bill by adding up 12 months’ worth of payments, then dividing by 12.

- Now determine how much you spend on entertainment, eating out, travel, and miscellaneous day-to-day expenses. These amounts will likely change from month to month; however, you can look back over the last few months to see how much you spend on having fun or impulse purchases. Estimate your monthly spend on these types of expenses and include these items in your budget.

And don’t forget to include savings as part of your budget plan.

Already setting aside a certain amount every month or paycheck? Great! Include the amount of monthly savings in your overall budget. Just getting started building your emergency savings? Determine how much you’re willing to start setting aside and include that amount in your budget.

Are you concerned about being on a budget? Wondering how to be financially responsible when friends and family invite you to do things?

Some people have found success with loud budgeting. This is a practice of letting friends, co-workers, and family members know–out loud–that you’re on a budget. You can explain to them that you’re declining certain invitations because spending for a concert or a weekend trip, for example, doesn’t support your financial goals. Try it!

You can practice breaking bad spending habits by identifying triggers and creating alternative behaviors.

Implementing the 50/30/20 rule

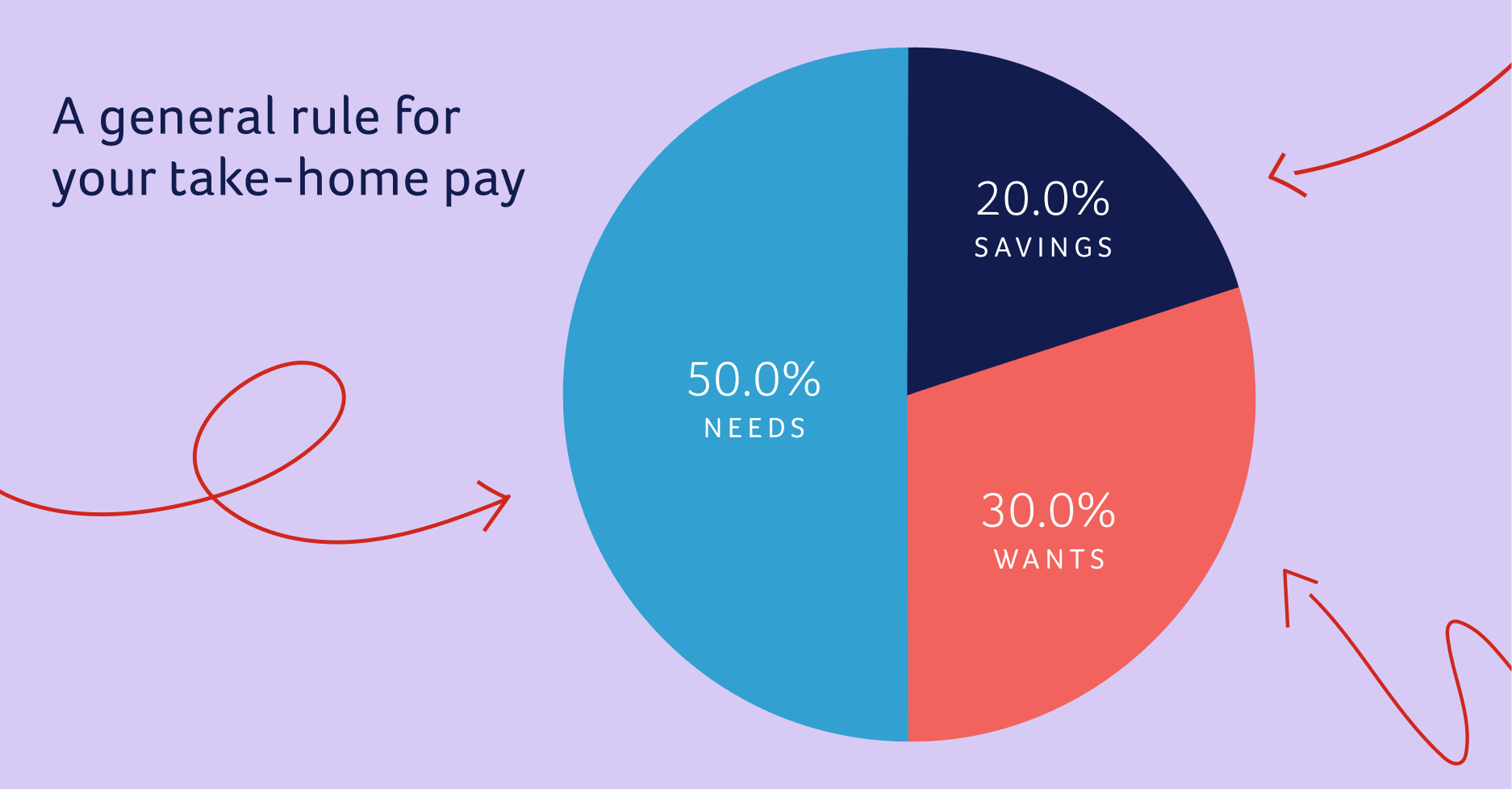

The 50/30/20 rule is a budgeting strategy that suggests you allocate your income as follows:

- 50% to needs

- 30% to wants

- 20% to savings (and debt repayment, if applicable)

Remember the wants vs. needs exercise? This pie graphic illustrating the 50/30/20 rule is helpful in showing money allocations. You can see that one-half of your money should go towards covering life’s “needs,” like rent, health insurance, and utilities. The next 30% can go towards your wants, like going out to dinner with your family or buying a new pair of shoes.

While 20% is the general recommendation for savings, you can always increase this amount and decrease your “wants.” Plus, if you have debt, the pie chart suggests how to be more responsible with money that goes towards savings. Pay off any debt as quickly as possible so you have more money to put in your savings.

Planning for the future

It may seem a whole lot easier to focus on the here and now because you have bills to pay or things you’d like to spend your money on. But becoming financially responsible involves knowing how to be more responsible with money, which can help create a solid financial future. You can start by setting clear financial goals. Ask yourself:

- Where do you want to be, financially, in five years? 10 years?

- Are you taking the actions needed to achieve your financial goals?

- Are your financial habits supporting your long-term vision?

Be honest with yourself about your current financial behaviors. Make small adjustments to continue working towards your future vision.

Making informed financial decisions

You make financial decisions every day. Sometimes they’re small decisions—like whether to get a coffee at your local coffee shop—and sometimes they’re bigger decisions, like which smartTV to buy.

So what does it mean to be financially responsible in every decision?

Think first about your budget:

- Have you set aside money to indulge in that coffee?

- Have you been saving up for a new TV?

- Or are you just splurging on the spur of the moment?

And for that larger purchase:

- Have you shopped around?

- Compared prices?

- Looked for a combination of quality and price?

Does it make sense to spend a little more to get better quality, so you don’t have to get another new TV two years from now? Or is it better to aim for a lower price because the quality is the same for all TVs in your price range?

Being financially responsible means being smart when making financial decisions, large and small.

Managing credit cards and debt wisely

In the realm of personal finance, managing debt is crucial. If you have credit cards, the key to financial responsibility is paying down the full amount every month.

Credit cards may become problematic when you’re only able to partially pay. The credit card company charges interest, or a certain percentage rate, on your unpaid balance. (This is how they make money! They charge you for not paying off the balance in full.) Many credit cards have extraordinarily high interest rates, often charging from 25 to 28 percent interest. If you carry a balance forward to the next month, you may end up paying way more for your purchase than its original cost.

So, how do you pay down debt?

Paying down debt: Snowball or avalanche method?

One popular method to debt repayment is the “snowball” approach. Just as a snowball grows and gains momentum as you roll it, this approach to debt is all about focusing on your smallest debt first.

To use the snowball method:

- Continue paying the minimum amount due on larger credit card debts.

- Pay a little extra each month on the smallest debt.

- Watch the smaller debt get smaller and smaller until it disappears!

- Then, move onto the next largest debt and follow the same process.

![[table title] Snowball vs. Avalanche Debt Repayment [column 1 title] Snowball [column 1 sub-items] Pay extra each month on smallest debt Pay the minimum on larger debts Watch the smaller debt get smaller until it's paid off Move on to next largest debt [column 2 title] Avalanche [column 2 sub-items] Pay extra each month on card with highest interest rate Pay the minimum on other cards Watch the highest interest card balance get smaller until it's paid off Move on to card with next highest interest rate](/wp-content/uploads/2025/03/responsible_spending_snowball_avalanche.png)

Or, you may prefer the “avalanche” approach, which can be especially helpful if you have multiple, high-interest credit cards.

- Identify which credit card charges the highest interest rate.

- Start making extra payments on the monthly balance of that card.

- Keep paying the minimum balance on your other cards.

- Watch the balance get smaller and smaller on the first card until it’s paid off.

- Then do the same thing with the card that has the next highest interest rate.

Avoiding common credit pitfalls

Building good credit is a crucial aspect of financial responsibility. Having bad credit or misusing credit cards can have a negative impact on your financial life and can follow you around for years.

Here’s how to start being financially responsible when it comes to credit:

- Don’t overspend.

- Don’t max out your credit limits.

- And never miss a payment.

Maxing your credit can cause an increase in your interest rate, and it can definitely impact your credit score. Your credit score is determined by a number of factors. One is your credit utilization ratio, which is how much credit you have (to spend) vs. how much you’re actually using. Use less credit to potentially see your score go up.

Missing or late payments can also impact your credit score, so be sure your payments are made on time. Having a history of on-time payments helps your credit score by demonstrating financial responsibility.

Saving Made Easy

Split deposit and Wisely Savings Envelopes make saving easy. Organize savings into envelopes assigned as different categories you create. Keep in mind: Even $10 a week adds up to over $500 a year!

Building an emergency fund

We’ve talked a lot about smarter spending and avoiding debt. Now let’s talk about creating an emergency fund as the foundation for financial stability.

Imagine you suddenly get sick and need $75 for an urgent care visit. If you’ve already allocated all of your money for the month and have no emergency savings fund, it may be tempting to take out a payday loan or charge the urgent care expense to a credit card.

The problem with using a short-term loan or credit card, however, is you may end up paying exceedingly high interest on that urgent care visit. Instead of $75, it may turn into much more, depending on the terms of the loan or how long it takes you to pay it off.

Now imagine you have $250 saved in your emergency fund. You can easily pay for the urgent care visit without disrupting your monthly budget.

People often fall into the debt cycle when having to pay for life’s little emergencies with a loan or credit card. Having an emergency fund helps prevent debt and is a healthy financial behavior that can help secure your financial future.

Leveraging Wisely for financial management

Use Wisely to build better financial habits.

- Track spending and manage finances with the myWisely® app.

- Avoid late fees with online bill pay.

- Build your emergency fund with Savings Envelope.

- Benefit from our rewards program.

BY Geoff Crossan Vice President & General Manager of Wisely by ADP

Committed to responsible spending? Manage your money Wisely®. Get started today.

The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. The Wisely Pay Mastercard® is issued by Fifth Third Bank, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. The Wisely Direct Mastercard is issued by Fifth Third Bank, N.A., Member FDIC. ADP is a registered ISO of Fifth Third Bank, N.A. The Wisely Pay Visa card can be used everywhere Visa debit cards are accepted. Visa and the Visa logo are registered trademarks of Visa International Service Association. The Wisely Pay Mastercard and Wisely Direct Mastercard can be used where debit Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

ADP, the ADP logo, Wisely, myWisely, and the Wisely logo are registered trademarks of ADP, Inc.

Copyright © 2026 ADP, Inc. All rights reserved.

By clicking 'Leave', you will exit myWisely and be directed to a third party website which may have different privacy and security settings.