Financial stability means peace of mind around money

You may have experienced times in your life when money was less of a concern so therefore you felt more financially “stable.” Perhaps you know the feeling of paying off some debt and having more money in your pocket to handle everyday expenses or to set aside savings.

But true financial stability is often defined as living within your means, being able to easily pay your bills every month, living free of consumer debt, and having a healthy emergency savings fund set aside for unexpected expenses. Let’s take a closer look.

What is financial stability?

A simple definition of financial stability is being able to comfortably live every month without worrying about money. You don’t overspend but you still enjoy doing things you love to do. You pay your bills on time and you have an emergency fund in place. Of course, financial stability also means having a steady, reliable income.

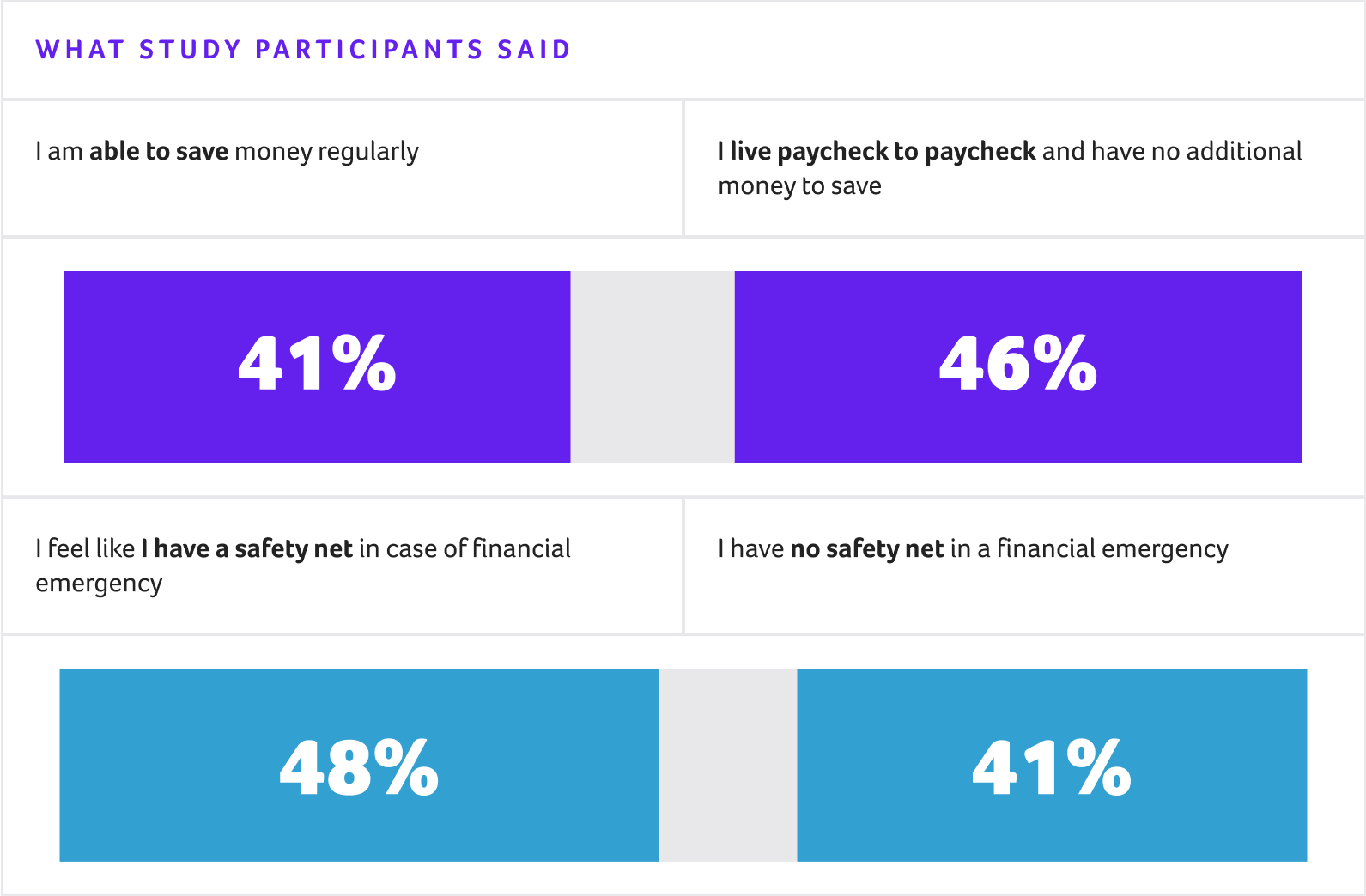

According to a Visa financial wellness research study commissioned by Wisely by ADP, nearly half the population lives paycheck to paycheck, without a safety net to fall back on.

How much money you need to be financially stable depends on a number of factors, including:

- Your current expenses

- Whether or not you share those expenses

- How much you have saved

- Any outstanding debts (e.g., students loans)

Other variables may include where you live and the cost of living in your area. Your financial stability could also depend on whether you have children to support or whether you’re a caregiver for a loved one. Different circumstances may cost more or less every month. Losing your job could also impact your financial stability, which is why it’s so important to build an emergency savings fund.

You can work towards financial stability today. It all starts with a decision, a plan, and some dedicated actions to help you establish a firm financial foundation.

Get Wise

Financial stability starts with a solid foundation. A Wisely® prepaid debit card can help you manage spending, pay bills,1 and save money.2

What it means to be financially stable

Here are some guidelines for becoming financially stable.

Live within your means.

Don’t spend more than you make, and don’t live beyond what your budget reasonably allows. Even the constant “stretching” of your budget is an unhealthy financial behavior because it may put you more at risk of relying on loans or credit, or simply feeling stressed out and uneasy about how to pay your bills and other necessities in life.

Be responsible with debt.

There are different types of debt. Home mortgage loans or auto loans are examples of secured debt. “Secured” means there is an asset (such as your home or your car) that you are offering up as collateral in exchange for the loan. If you fail to repay the loan, the lender can seize the asset and try to recover some of the funds.

These are generally acceptable types of debt because houses and cars are such big-ticket items, most people can’t afford to pay for them in cash. Where debt can become irresponsible is when you charge your credit card for something you can’t pay off. To be financially stable, it’s important to set aside savings or plan for purchases. If you use credit cards, try to pay the full balance every month to help avoid going into debt and paying finance charges.

Have an emergency fund.

Setting aside savings for life’s unexpected expenses is critical to financial stability. It is part of an ongoing, lifelong, healthy financial behavior and commitment to being financially stable. When you have funds set aside, you may be able to handle things like a medical bill, an insurance payment, or an auto repair without having to impact your daily cash flow. This can help you stay on track (and ahead) rather than constantly falling behind, or worse, taking out payday loans or using credit to cover emergency expenses.

Why is financial stability important?

Being financially stable could potentially have a positive impact on your mental health by providing improved peace of mind. When you’re not worrying about finances, you may be free to focus on other things, such as the enjoyable aspects of life like time spent with your family and friends.

When you have financial stability, you may be less stressed because you have money to pay your bills. Or perhaps you have money set aside in your emergency fund for unexpected expenses, so you’re less worried and distracted about how you’re going to pay for the expense.

On the other hand, being financially unstable could impact your mental well-being as well as your physical health. Constant stress over money could contribute to mental health conditions or even trigger physical responses.

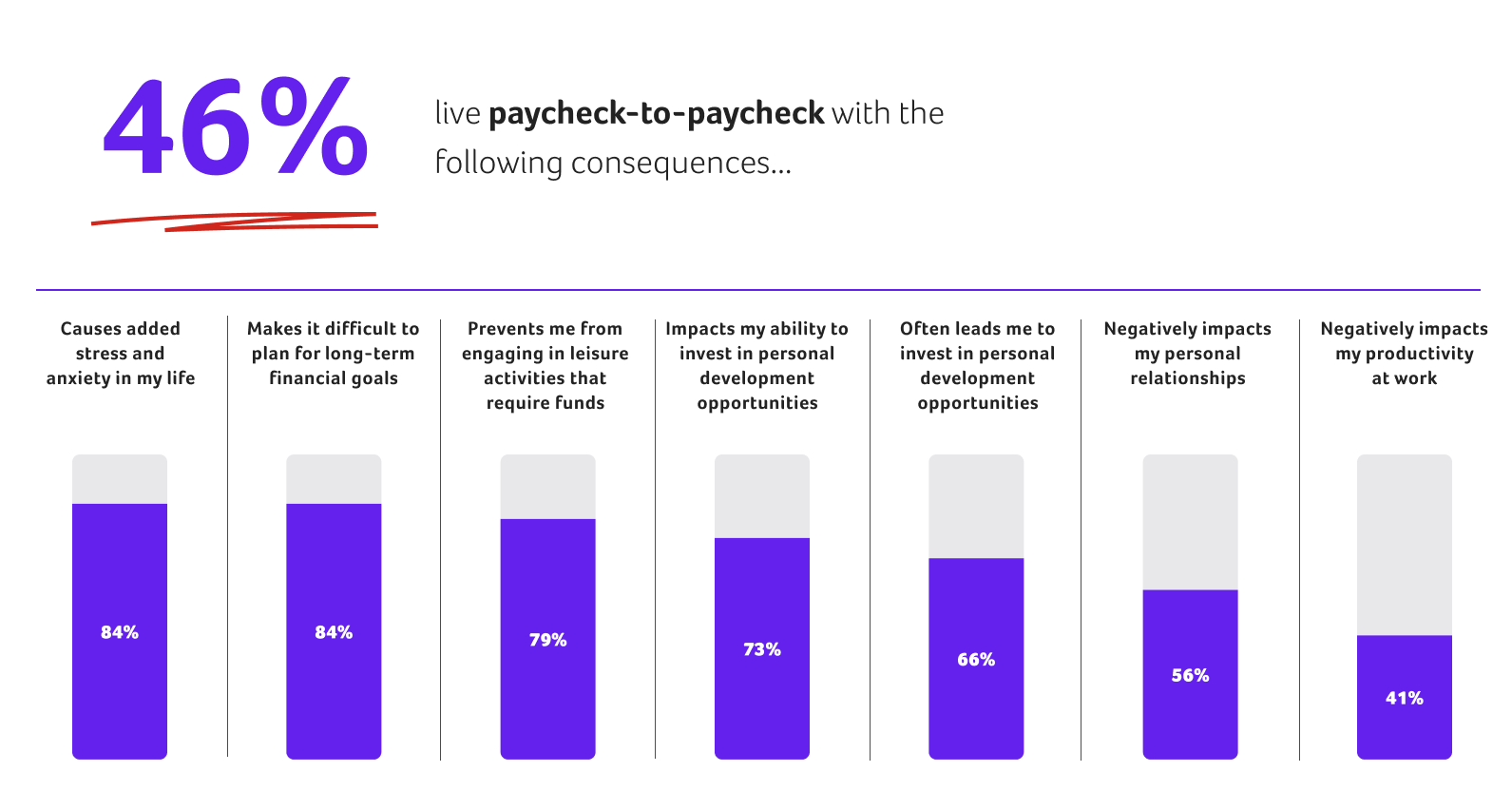

Living paycheck to paycheck makes it difficult to plan for long-term financial goals, prevents participation in leisure activities, negatively impacts ability to invest in personal development, and even deters healthy eating. — Visa financial wellness research commissioned by Wisely by ADP in September 2023

So, how do you become financially stable?

The answer is the same whether you’re just starting an emergency fund or climbing out of debt. Being financially stable usually means having a certain confidence around money. It means you’ve implemented healthy habits, like living within a budget while still giving yourself permission to indulge here and there – to enjoy what life has to offer.

Financial stability may also be defined as being debt-free or having a manageable amount of debt you’re able to pay down consistently. Being financially stable means treating your savings as though it were a monthly “bill,” automated and prioritized just like your car payment or a phone bill.

Start from where you are with an eye on where you plan to be. Take it step by step. It will take time. There will be setbacks. And sometimes you may want to give up completely on the whole idea. That’s okay. Keep going anyway.

Plan Today for Tomorrow’s Unplanned

With Wisely, set up automatic transfers to your Savings Envelope,2 for those unexpected expenses, like car repairs or medical bills.1

When you’re managing your day-to-day finances, it can be challenging to think about long-term financial stability. Here are some simple actions you can take every day that can help shape your financial future.

1. Treat automatic savings like an expenditure.

Just as you have certain bills to pay every month, you can also have certain savings amounts “billed” every month. Make automatic savings part of your monthly budget. Even if you start with just $5 every month or every two weeks, setting aside savings on a consistent basis will empower you to keep saving and growing your savings, which is crucial for becoming financially stable.

2. Build your short- and long-term emergency funds.

As part of your overall savings strategy, it’s critical to start an emergency fund that can help you meet unexpected expenses. This is even more important if you find yourself relying on credit cards or payday loans to get you through challenging financial situations or to bridge the gap between paydays. Having just $100 set aside could help you meet an emergency medical expense or something your child needs. You can start small and work your way up to an emergency fund that can sustain your needs for a few months if you were to lose your source of income.

3. Use a monthly budget (and live by it).

Budgeting can provide clarity and could help minimize the risk of overspending or miscalculating, which could also help reduce stress and anxiety around money. Having peace of mind around finances can be a side benefit of financial stability. When you know exactly what you have and where it’s going, you can determine what to cut back on, and where you can spend, or redirect money.

4. Trim the excesses from your spending while still treating yourself.

We often feel entitled to “have” things. We tell ourselves that because we work so hard, we “deserve” to have that Starbucks coffee, a fancy meal out, a nice new outfit, an upgraded mobile phone, or even a new car. Be honest with yourself about where you’ve been spending because you feel you deserve things in life. Determine whether those “indulgences” are undermining your ability to be financially stable. Consider keeping a couple of “guilty pleasures” that bring you joy and letting go of the ones you could seriously live without and that are draining your accounts.

5. Pay more than the balance due on your credit card.

If you have credit card debt, you know the burdensome feeling of carrying a balance. Every month that goes by, you could be paying more than the actual price tag for all those things you bought on credit. Plus, for all the money you’re paying on your credit card, you have less money to spend on other things.

When you’re ready to seriously take on your debt so you can be financially stable, start with the snowball method of paying your smallest credit card bill off first. While you continue to pay the balance due on other cards (if you have them), you pay more than the balance due on your smallest card balance. Do this until that card is paid off; then do it with each of the others. By using this method, it could feel less overwhelming because you see at least one of your card balances actually going down rather than all balances seeming to stay the same every month.

6. Make more money to supplement your income.

Not everyone wants to pick up gig work or a second job, but some people find joy in hobbies or passions that are income-producing. You may be able to provide a service that allows you to create your own hours while bringing in a few extra bucks. If there’s something you’ve always enjoyed doing or have dreamed of doing, why not come up with a plan? Your dream could become a steady money-maker that helps build financial stability.

7. Make adjustments over time.

Becoming financially stable takes time. It requires attention and work. It also requires ongoing adjustments based on changes in lifestyle, health, partner/spouse, job/career, family, income, and other factors. Assess your situation from time to time to see how your priorities and values have changed. Keep making adjustments that support you and your family’s vision of financial stability.

8. Have a vision for your financial future.

Create a roadmap for where you want to be, financially. Write down exactly what you want to have in your life. What does that future look like? Who will be there? Where will you live? What will you be doing? How will you feel? And most importantly, how will you feel about money? Imagine feeling financially stable because you started today, taking actions to get there.

Start building financial stability

Learn from your mistakes and be committed to saving and growing your money so you can have a financially stable future. Starting now.

By the Wisely Team

By the Wisely Team

Financial stability begins here.

Get started with Wisely.

Footnotes

- The bill pay feature, powered by Papaya, is available through the myWisely app. Additional terms and limits apply. This optional offer is not a Fifth Third Bank, Pathward, Mastercard or Visa product or service, nor does Fifth Third Bank, Pathward, Mastercard or Visa endorse this offer. ↩

- Amounts transferred to your savings envelope will no longer appear in your available balance. You can transfer money from your savings envelope back to your available balance at any time using the myWisely app or at mywisely.com. ↩

This content is for informational purposes only and may have been derived, with permission, from a third party. While we believe it to be accurate as of the date of publication, it does not constitute the rendering of legal, accounting, tax, or investment advice or other professional services by ADP and it is being provided without any warranty whatsoever. Please consult with appropriate professionals related to your individual circumstances.

The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward®, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. The Wisely Pay Mastercard® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. The Wisely Direct Mastercard is issued by Fifth Third Bank, N.A., Member FDIC. ADP is a registered ISO of Fifth Third Bank, N.A., or Pathward, N.A. The Wisely Pay Visa card can be used everywhere Visa debit cards are accepted. Visa and the Visa logo are registered trademarks of Visa International Service Association. The Wisely Pay Mastercard and Wisely Direct Mastercard can be used where debit Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

ADP, the ADP logo, Wisely, myWisely, and the Wisely logo are registered trademarks of ADP, Inc.

Copyright © 2024 ADP, Inc. All rights reserved.