Preventing debit card fraud is best defense

Debit card fraud and scams are on the rise. Not to mention, fraudsters are constantly developing new tactics for tricking consumers into handing over valuable personal information.

On the one hand, you may receive legitimate emails from your financial institution with tips on how to prevent debit card fraud. On the other hand, debit card scammers posing as bank employees may send you urgent alerts about your account activity, trying to convince you to share personal information.

It’s more critical than ever to protect your financial information and have heightened awareness of the latest debit card fraud techniques.

Understanding debit card fraud

Scammers can gain access to your information in a variety of ways, from security breaches to card skimming to social engineering. Your information can be accessed via:

- The Dark Web – This refers to pages on the web that can only be navigated with special software. Users browse anonymously and are untraceable by law enforcement, making it easier to commit crimes (like stealing data) and never be caught.

- Malware on websites – This technology can steal information from your computer while you’re typing on your keyboard.

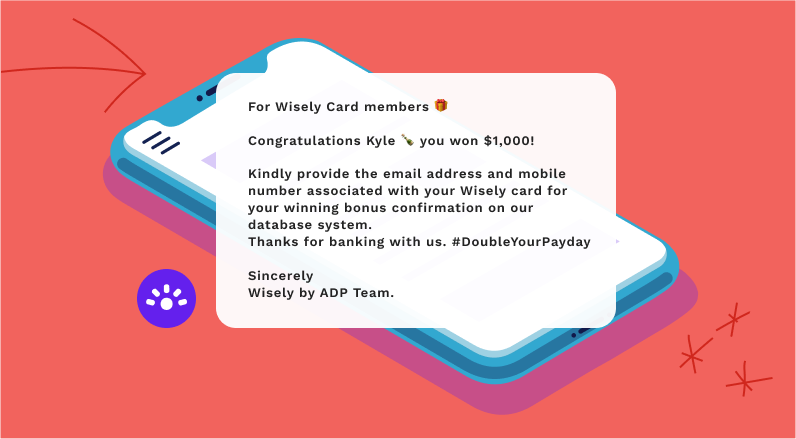

Fake social media accounts – Fraudsters posing as your banking institution on social media may try to entice you to hand over your information.

Example of a fake Wisely direct message on Instagram

Example of a fake Wisely direct message on Instagram

Protecting yourself from debit card fraud means being aware of the variety of fraud tactics being used and being careful about sharing personal information. It’s also wise to be aware of the protections that come with your debit card in case a fraudster gets ahold of your information.

Get Wise

Wisely will never ask you for your passwords, login credentials, username or one-time-passwords (OTP) via phone, email or text.

Types of debit card fraud

Debit card fraud takes many forms. Some of the most common types include:

Data breaches

An example of a data breach is when your password(s), or other personal information used for various accounts and websites, are accessed by hackers. This information can then be used to access your online bank accounts and even your banking apps. While many of us are aware of such risks, we often continue to use the same usernames and passwords for different websites and types of transactions, making it easier for fraudsters to steal money and personal information.

Skimming

A card skimmer is a device attached to a point-of-sale (POS) terminal or card reader. Skimmers are often placed in retail stores, ATMs, or gas station pumps. Card skimmers usually blend into the original hardware of the machines they are attached to, so they can be difficult to spot.

The device will copy the information of the magnetic strip which can be found on the back of your card. The fraudster may also use a stealth camera that records your pin as you enter it. Or, in the case of most gas pump skimmers, it may contain a data-collecting device that stores and transmits your card data to an identity thief. More high-tech thieves might even 3D print a new keypad for a machine to use for recording PINs (personal identification numbers). Once the fraudsters have obtained the information from your card, they can create a counterfeit card and start to use it.

Social engineering/account takeover

This is when someone pretends to represent an institution you trust (like your bank or card provider) and tries to convince you to provide them with personal information. They might ask you to provide them with a OTP (one-time-password) received via SMS (text) message. They may be able to indicate accurate information about your account while urging you to take action with a phone call or by clicking a link.

When you respond, the fraudster – posing as a card provider or bank employee – shows concern over a transaction, encouraging you to answer questions so you can get your money back quickly. Their aim is to gain your trust by making you think they care about your account security, but their ultimate goal is to obtain your password. Once they have tricked you into providing the necessary information, they can log into your account and immediately remove funds from your account.

What are some warning signs of debit card fraud?

There are some warning signs of debit card fraud to be aware of so you can quickly take action to prevent further damage:

- You notice unauthorized transactions in your account. If you notice any suspicious account activity, even if it’s low dollar amount transactions, pay attention and investigate.

- Something feels “off” about a transaction. Perhaps your card suddenly stops working when you know there’s money in your account. Follow your instincts and check your account activity. Call the number on the back of your card if you suspect fraud.

- You receive an alert to click a link or call to confirm a transaction. While your bank or card provider may legitimately send you such alerts, it’s important to be able to recognize the validity of the sender.

Do debit cards have fraud protection?

Yes, debit cards have fraud protection under the Electronic Funds Transfer Act (EFTA), a federal law protecting consumers when using debit cards, ATMs, auto-withdrawals from bank accounts, and other types of electronic transfer of funds. The EFTA allows for transaction error correction and also limits your financial liability for unauthorized transactions.

Protection under the EFTA, however, requires you to report fraud charges on a debit card within a certain period of time. The longer you wait to report fraud, the more financial responsibility you might have. When you report debit card fraud or loss of a card:

- Within two days, your liability limit is $50

- Within three to 59 days, your liability could be up to $500

- After 60 days, you may be 100% liable for any charges to your account, including overdraft charges

How does debit card fraud protection work?

With debit card fraud protection, there are safeguards in place to protect consumers. Keep in mind, however, if your debit card is lost or stolen, you must notify your card provider immediately to begin an investigation.

Here are some additional ways you can protect yourself from fraud and keep your accounts secure.

Get Protection

Certain transactions are protected by either the Visa® or Mastercard® Zero Liability Policy1, which provides protection from unauthorized purchases. Other restrictions may apply.

Real-time alerts

In your mobile app settings, you may be able to customize what kinds of alerts you’d like to receive (text or email) and how much security you prefer. Some people like to receive an alert every time there’s a transaction so they know instantaneously if there’s ever a transaction that’s not their own. Other people prefer to receive alerts only when a transaction is over a custom amount they’re comfortable with. Real-time alerts are important because the sooner you’re able to recognize a fraud charge on your debit card, the sooner you’re able to notify your card provider and they can potentially do something about it.

EMV chip technology

EMV stands for Europay, Mastercard and Visa. An EMV chip is the little computer chip you see embedded in debit cards. This technology enables a unique code to be created for every single transaction. With encryption and tokenization, EMV card data is more difficult to illegally copy at the time of use. This helps prevent theft of card information that would be used for unauthorized purchases. There’s no guarantee your card won’t be compromised when you use an EMV card, but the EMV adds an extra layer of protection a non-EMV card cannot provide.

Employers sometimes provide new employees with a non-personalized debit card as part of new hire welcome packages. If you have received a debit card without an EMV chip, be sure to inquire with your card provider about how to obtain a card with an EMV chip, such as upgrading your card account for greater fraud protection.

Transaction monitoring

In addition to receiving real-time alerts, it pays to keep tabs on your account. Here are some best practices for monitoring your transactions:

- Log into your app frequently.

- Review transactions within the last few days and weeks.

- Report any suspicious activity immediately.

Temporary card lock

Most banking apps allow you to quickly log in and toggle a button to temporarily block card use. You can always call your debit card provider as well to let them know if you think your card or information has been lost or stolen. Of course, using this function will also prevent you from being able to use your own card. Once you’ve determined your card or information is safe, you can always remove the temporary card block. If your debit card has in fact been compromised, you’ll need to request a replacement card from your provider.

How to report debit card fraud

As soon as you become aware of potential fraudulent activity on your debit card, be sure to lock your card via mobile app, online banking, or by phone. (Refer to your cardholder agreement for details on how to report debit card fraud.)

It might also be helpful to keep your card provider’s phone number in your phone contacts and to also add their fraud contact information, if available. Once you’ve contacted your card issuer about your concerns, they can begin investigating the dispute and will send you a new card.

Keep in mind, your banking institution or debit card company will NEVER ask for:

- Your personal identification number (PIN)

- One-time passcodes

- Multi Factor-authentication codes

Your provider will ask questions to validate you are who you say you are when you call to report debit card fraud. They’ll ask questions to find out what happened for you to lose your money and they are committed to securing your account and helping you get your money back.

Remember: Only call the number on the back of your card. Never call a different number that’s been sent via email or text message.

Keep your debit card provider’s phone number handy in your phone address book. Be sure to add fraud contact information, if applicable.

How to protect your debit card

Although fraudsters keep coming up with new ways to access consumer financial information, there are some tried and true ways of protecting your debit card.

- Keep your physical card secure. Be aware of your personal belongings in public places. Be mindful about using your PIN on keypads. Don’t be embarrassed to use your hands to hide your movement.

- Change your passwords regularly. Most people don’t because it feels inconvenient to have to manage multiple usernames and passwords. Consider using a password management app to help keep your passwords secure, updated, and in one place.

- Sign up for alerts. Stay on top of your financial transactions in real time by receiving text or email alerts. That way you can let your debit card provider know of any suspicious activity as soon as you discover it.

You work hard for your money. Do everything you can to protect it.

BY Arif Alibhai Sr. Director Compliance Design, ADP

Protect yourself against debit card fraud. Get started with Wisely.

Footnotes

- Visa’s Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use. Contact your issuer for more detail. And Mastercards Reads: “Under MasterCard’s Zero Liability Policy, your liability for unauthorized transactions on your Card Account is $0.00 if you notify us promptly upon becoming aware of the loss or theft, and you exercise reasonable care in safeguarding your Card from loss, theft, or unauthorized use. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.” Both must be included. You will need to add associated disclaimer mark for each here in text and then the disclaimers at the bottom of the page. This is a network requirement. ↩

- If you have a Wisely Pay card or Wisely Cash card (see back of your card), access to certain features or loading funds from sources other than the company you received your card through requires an upgrade, which you can request in the myWisely app or by calling the number on the back of your card. Requesting an upgrade will automatically initiate an identity verification process utilizing your personal information already on file which must be validated in order to upgrade. Card may be restricted or closed if your identity cannot be verified. Upgrade may not be available to all cardholders. If you have a Wisely Direct card (see back of card), you’re already upgraded. ↩

- Standard message fees and data rates may apply. ↩

This content is for informational purposes only and may have been derived, with permission, from a third party. While we believe it to be accurate as of the date of publication, it does not constitute the rendering of legal, accounting, tax, or investment advice or other professional services by ADP and it is being provided without any warranty whatsoever. Please consult with appropriate professionals related to your individual circumstances.

The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward®, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. The Wisely Pay Mastercard® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. The Wisely Direct Mastercard is issued by Fifth Third Bank, N.A., Member FDIC. ADP is a registered ISO of Fifth Third Bank, N.A., or Pathward, N.A. The Wisely Pay Visa card can be used everywhere Visa debit cards are accepted. Visa and the Visa logo are registered trademarks of Visa International Service Association. The Wisely Pay Mastercard and Wisely Direct Mastercard can be used where debit Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

ADP, the ADP logo, Wisely, myWisely, and the Wisely logo are registered trademarks of ADP, Inc.

Copyright © 2025 ADP, Inc. All rights reserved.

By clicking 'Leave', you will exit myWisely and be directed to a third party website which may have different privacy and security settings.