So, you’ve got your direct deposit all set up. Great! Direct deposit offers a convenient way to get your paycheck deposited directly into your account, without having to hassle with a physical check. In fact, it’s how most working Americans receive their pay, according to NACHA, which oversees the operating rules for the (Automated Clearing House) ACH network, which processes electronic payments and transfers across the United States.

Now it’s time to be even more strategic about money management by splitting your direct deposit into multiple accounts. Whether you’re looking to establish an automated savings habit or to funnel funds into an account that’s just for paying bills, split direct deposit can help support your financial goals.

In this guide, we’ll look at how split direct deposit works and how to set it up, the potential advantages and disadvantages, plus some additional automation tips to optimize your financial planning.

Understanding split direct deposit

First, what is a split deposit? A split deposit is a benefit of direct deposit that allows you to automatically split your paycheck into several different accounts. If you currently have all of your pay going into one main account, you may choose to have some of that money distributed into a separate account or multiple accounts, which may be at one financial institution or several different ones.

Many employers have payroll systems that allow you to log in and control how your paycheck gets distributed. Within the system, you may be able to choose to direct a certain percentage or an exact dollar amount to different accounts by providing the routing and account numbers for your various accounts.

Let’s say you get paid twice a month and you want to channel money into a checking account that’s just for paying your bills, adding up to about $400 per month. You could opt to have $200 from each paycheck deposited to the account from which you pay your bills, for a total of $400 per month dedicated to bill payments – money that’s kept separate from your everyday spending account.

Or perhaps you wish to set up an automatic savings plan to start building your emergency fund. With split direct deposit, you can have a portion of your paycheck direct deposited into your savings account.

If your employer doesn’t offer automated split pay, you can still set it up manually. Once you receive your direct deposit, just transfer a certain amount from your main account to the various accounts you want the money to go to. You may also be able to set up automated transfers to help you stay disciplined.

Split direct deposit is ideal for people who receive approximately the same amount every pay period because you know exactly how much you’re receiving and how much you can safely distribute to other accounts.

Something suggestive of money being channeled into different accounts (also show/include a prepaid debit card concept, consistent with Wisely offering)

Get Paid Up to Two Days Early with Wisely

Life doesn’t always wait until payday. Nor should you. Whether it’s a bill coming due or something you want ahead of the weekend, Wisely can get you access to your pay up to 2 days early - at no cost to you.

Can you split direct deposit between two banks?

Yes! In most cases, you can split direct deposit between two banks (or more) depending on your employer’s payroll system. To split your pay between multiple banks or different prepaid debit cards, you’ll need your routing and account number for each account. Again, determine how much–a fixed dollar amount or a certain percentage–you wish to distribute to each account.

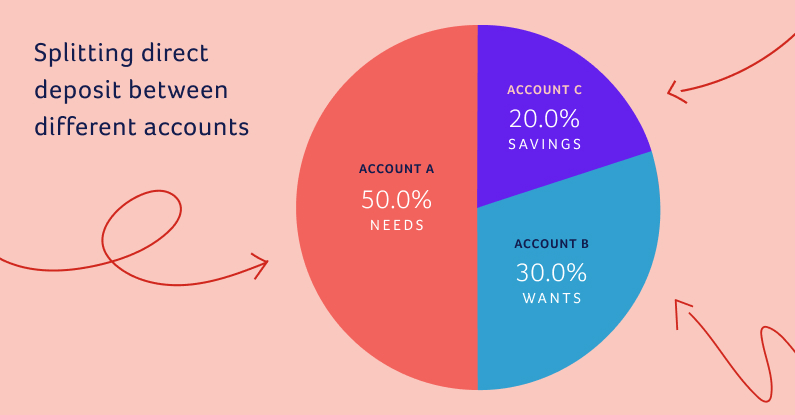

Let’s look at a potential example, following basic budgeting principles. Many people find it helpful to apply the 50/30/20 rule:

- 50% of your pay towards “needs”

- 30% towards “wants”

- 20% to yourself, for everyday spending

Having split direct deposit between different accounts or prepaid debit cards can make it easier to adhere to the 50/30/20 rule. For example, you could split:

- 50% into Account A

- 30% into Account B

- 20% into Account C

Could be interesting to illustrate the 50/30/20 concept with “account allocations” – Account A, B, C

Why consider splitting direct deposit?

When it comes to budgeting and developing healthy financial habits, using split direct deposit can be a great way to separate certain expenses from everyday spending and to automate your savings, for short- or long-term goals. Plus, it’s free. There’s typically no additional charge for distributing your own money to different accounts.

Advantages of split deposits

Let’s look at some of the advantages of split deposit, from better money management to financial goal achievement.

- Automated savings – Automatically directing funds into a savings account encourages consistent saving without requiring manual transfers. And it’s a great way to build your emergency savings fund.

- Budget management – Allocating funds to different accounts can help segregate expenses, making it easier to adhere to a budget and easier to manage your money.

- Goal achievement – Directing money toward specific accounts earmarked for goals like vacations or an emergency fund can help you reach your goals faster.

Potential disadvantages of trying to split paychecks into different accounts

Splitting your paycheck into different accounts may present a few challenges. Here are some potential disadvantages:

- Employer may not allow it – Not all employers offer an online payroll system that lets you easily split your paycheck into multiple accounts. While it may still be possible to move your money into different accounts, it may require alternative strategies and more manual work.

- Not having lump sum easily available – When you distribute your pay into smaller amounts across different accounts, this reduces your liquidity, which is the amount of “cash” you can access quickly and easily, typically from a single, readily available account.

Get Ahead of Paying Your Bills

Pay bills online with Wisely. Schedule payments in advance so you never miss a due date.

How to set up split direct deposit

Before you set up split direct deposit, of course, you’ll need to set up direct deposit, if you haven’t already. Start off by thinking about your monthly expenses as well as your financial goals. It may help to write everything out on paper first, so you can think it through before committing to splitting your paycheck.

Here’s how to split direct deposit into two accounts:

1. Assess employer policies and options.

Check with your employer’s payroll or human resources department to determine if split direct deposit is available and understand any specific procedures or limitations. Some companies require you to complete a split direct deposit form provided by your employer’s HR team.

2. Determine allocation strategy.

Whether you choose a fixed amount or a percentage to be distributed into a different account(s) is entirely up to you. There are no right or wrong allocation strategies. It’s more about what you’re trying to accomplish and how split direct deposit can help you. Once you’ve determined your goals, figure out if it makes sense to distribute an exact amount or a percentage of your pay each pay period. Keep in mind, you can always change your allocations, but it might take a few pay periods for the change to take effect.

3. Provide necessary account information.

Figure out which accounts you wish to split your pay into and gather up your routing and account numbers. These will be needed when you’re setting up split direct deposit, so you can indicate which accounts receive which amounts from your paycheck.

4. Confirm and monitor deposits.

Nervous about splitting your direct deposit into different accounts? It’s okay to start small, with a fixed amount going into a separate account. Then you can assess how it affects your remaining pay. If your first split deposit goes well and everything looks good, strategize for additional split pay opportunities.

Best practices for allocating your paycheck

Using split direct deposit is good for budgeting, good for saving, and good for online bill pay management. Here are some best practices for allocating your paycheck to different accounts.

Prioritize essential expenses

Remember the 50/30/20 rule? Think about your monthly needs, which would be things like your household utilities, rent or mortgage, transportation or auto expenses, and groceries. Part of responsible spending is making sure your primary needs are consistently met and paid for.

Automate savings for financial goals

Determine how much you’d like to save each month. If you’re concerned about not having enough leftover for spending, then start small. Even $10 per pay period can add up over time. Keep in mind the importance of having an emergency savings fund. It’s another way to support your financial stability.

Adjust allocations as financial situations change

Got a raise? Have a second income? You can always adjust your split direct deposit as your income, needs, and financial priorities change. For example, it may be tempting to put more money in your pocket for spending after you receive a nice raise. On the other hand, you could pretend like you didn’t receive a raise at all, instead allocating the extra funds directly to your savings. This way you could potentially save more without feeling much difference in your day-to-day financial life.

Something illustrative of “automation” – automate savings, automate bill payment, automate budgeting, etc.

Plan Today for Tomorrow’s Unplanned

With Wisely, set up automatic transfers to your Savings Envelope, for those unexpected expenses, like car repairs or medical bills.

Additional ways to automate your financial plan

In addition to splitting direct deposit, consider these automation strategies to help you achieve your financial goals.

- Make online bill payments – Set up bill payment in advance to have your bills paid online on a certain date, which can help prevent late fees. Plus, knowing your bills will be paid on time promotes peace of mind.

- Make transfers between accounts – Many financial institutions allow you to easily transfer funds between multiple accounts while also letting you transfer money to external accounts. External account transfers may take some manual setup (for example, two small sample deposits would be made from one bank to another, which you would then have to verify for security purposes). Once you have all of your accounts “working together,” it can be easier to manage your money.

- Use financial management apps – Many financial apps have features that allow you to track expenses, create a budget, set up automatic transfers, and easily see where your money goes on a monthly basis. Apps also offer the convenience of being able to check your accounts without having to log into a website. Ongoing monitoring via an app is also a good practice for becoming financially stable.

Use the myWisely® app to check your balance, view transaction history, find nearby ATMs, or see spending trends while you’re on the go.

Using Wisely for split direct deposit

With Wisely you can split your direct deposit and leverage tools for budgeting and money management.

- Early direct deposit – Arrange to get paid up to 2 days early.

- Online bill payment – Schedule payments in advance and pay securely, right from your myWisely® app.

- Rewards program – Earn discounts where you already like to shop, dine, and travel.

By the Wisely Team

Interested in split direct deposit? Make it work with Wisely, starting today.

Footnotes

This content is for informational purposes only and may have been derived, with permission, from a third party. While we believe it to be accurate as of the date of publication, it does not constitute the rendering of legal, accounting, tax, or investment advice or other professional services by ADP and it is being provided without any warranty whatsoever. Please consult with appropriate professionals related to your individual circumstances.

The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. The Wisely Pay Mastercard® is issued by Fifth Third Bank, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. The Wisely Direct Mastercard is issued by Fifth Third Bank, N.A., Member FDIC. ADP is a registered ISO of Fifth Third Bank, N.A. The Wisely Pay Visa card can be used everywhere Visa debit cards are accepted. Visa and the Visa logo are registered trademarks of Visa International Service Association. The Wisely Pay Mastercard and Wisely Direct Mastercard can be used where debit Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

ADP, the ADP logo, Wisely, myWisely, and the Wisely logo are registered trademarks of ADP, Inc.

Copyright © 2026 ADP, Inc. All rights reserved.

By clicking 'Leave', you will exit myWisely and be directed to a third party website which may have different privacy and security settings.